What will it really cost to set up an independent Scotland? A critique of Patrick Dunleavy’s report

Iain McLean comments on a report by Patrick Dunleavy that claims that, in the event of a Yes vote in the upcoming referendum, there would be immediate set-up costs of only £200 million in stark contrast to the UK government’s own estimate of £2.7 billion. Iain argues that the number is likely to be in the area of £1.5 to £2 billion when considering the two huge set-up costs that Scotland would incur after independence in the areas of tax collection and benefits distribution. Patrick Dunleavy responds to Iain’s criticisms here.

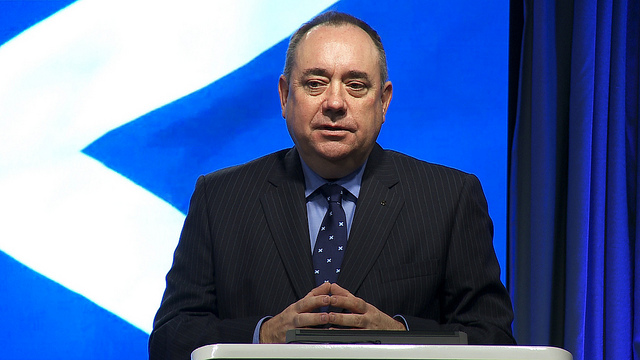

Patrick Dunleavy of this parish has been much in the news. His recent report contains the headline claim that ‘Scotland’s immediate set-up costs are likely to be constrained –we suggest around £200 million in one-off costs’. This was widely picked up by the press, who contrasted it with a UK government estimate of £2.7 billion, which Patrick himself had called ‘bizarrely inaccurate’ and a misinterpretation of his research. In his typically bullish way, First Minister Alex Salmond has written to Prime Minister David Cameron to say:

“Why did one part of the UK Government issue a figure of £2.7 billion when the Scottish Secretary himself believes the figure is around one-thirteenth of that claim? … Professor Dunleavy’s report this weekend has vindicated the Scottish Government’s position and demolished that of the UK Government.”

Patrick’s report contains equally robust language. It complains, for instance, that unionists have demanded cost data from the Scottish Government that only ‘the Delphic oracle’ could be expected to produce; and that the two latest reports from the professional association of Scottish Chartered Accountants (ICAS) ‘dwell … in a rather vague way on the complexities of running a tax system’.

Preliminary warning: never underestimate a CA (i.e., a Scottish Chartered Accountant). My father was one. They know more than anybody outside HMRC about the costs of running a tax system. Their views need to be taken very seriously. Reviewing their reports and other sources leads me to think that Patrick’s estimate and HM Treasury’s of the one-off costs of independence are actually roughly the same. Not £200 million; not £2.7 billion; but somewhere between £1.5 billion and £2 billion. Furthermore, there is evidence that the Scottish Government knows this, and would not have to go to Delphi to find it out. It need only ask a chartered accountant.

The £200 million, as Patrick’s report makes clear but the First Minister’s gloss on it does not, relates only to the cost of creating the central departments that would have to deal with functions that Scotland does not already deal with – defence, foreign affairs, social protection – and associated quangos. As to the latter, Patrick complained that HM Treasury absurdly scaled up the cost of creating a list of organisations to replace its list of UK public bodies functioning in Scotland. His report supplies a much lower estimate, but does not give the basis for that estimate in detail.

But quango, schmango. That is not where the real problem lies. The two huge set-up costs lie in tax collection and benefits distribution. One may fairly say that these (especially the latter) are things that the UK does not do very well, and that an independent Scotland could do better. The point is that on independence day and for quite some time afterwards they will still be done by HM Revenue & Customs (HMRC) and the Department of Work and Pensions (DWP) respectively. Scotland would not be able to make any changes in tax rates, tax bases, benefit rates, or benefit entitlements until it had transferred all tax collection to Revenue Scotland and set up its own version of DWP. On any reckoning, the costs of doing these two things dwarf Patrick’s £200 million. His report calls them ‘transition arrangement costs’ and ‘disentangling costs’, distinguishing them from ‘set-up costs’ (Dunleavy Report, Figure 5). But they ARE set-up costs. They have to be done if Scotland becomes independent. They don’t have to be done otherwise. And they are one-off, deadweight burdens on the Scottish taxpayer (also on the rest-of-the-UK taxpayer). The only proper title for them is “set-up costs”. That the set-up will not be on independence day does not alter this one jot. Or tittle, come to that.

If I want to know the cost of a tax regime I prefer asking an accountant than a politician. So what do the CAs think? Here are two key conclusions:

The first challenge might be the nature of the agreement for sharing services and costs under which the White Paper states that HMRC will operate the tax system for an independent Scotland in a transitional phase….

Examples from other countries can point towards the scale of [one-off] costs which might be incurred. In New Zealand, for example, changes to the tax system which are less complex than those for an independent Scotland are costing around £750m. The cost for an independent Scotland could be significantly greater, especially considering the scale and the complexity of the legacy systems which might be inherited from the UK. (ICAS, Scotland’s Tax Future: taxes explained, May 2014, pp. 12, 13).

Their first point highlights a certain cost that Patrick’s report ignores. After independence, neither HMRC nor the DWP is going to operate the tax and benefit systems of a foreign country for free. There will be a charge. We don’t know how much; but it is a one-off transitional cost.

In the second paragraph they suggest a floor cost of setting up a complete tax system for Scotland of £750 million. Almost certainly the cost would be more, because of two elements of disentangling. One relates to staff. HMRC staff often not based where the revenue they tax arises. For instance, Revenue Scotland would have to create a North Sea Oil division from scratch, by either transferring or replacing the HMRC staff who administer these taxes in London. The other relates to the web of deductions and allowances in income and corporation tax. Once a taxpayer (person or business) has been declared resident in Scotland, many of their reliefs and allowances become cross-border.

Perhaps then that £750 million should be £1 billion. Evidence that that is the right ballpark comes from the one set of taxes that have already been devolved to Revenue Scotland – Landfill Tax and Land & Buildings Transaction Tax. Based on Scottish Government estimates presented to the Scottish Parliamentfor the set-up costs of these two little taxes (about £1.65 million), the UK Government extrapolated the costs of a new tax system for Scotland to £562 million (Box 2E). That is almost certainly an underestimate. Land doesn’t move and can’t be hidden. Land taxes are therefore much the cheapest taxes to collect. People move and hide; goods are smuggled in white vans; businesses can ‘move’ at the touch of a mouse (ask Amazon). This helps convince me that £1 billion for tax administration set-up is the right ball-park figure.

What about benefits administration? Nobody would want to copy the DWP’s systems. We would expect Scotland to have something cheaper and better. The DWP estimates the IT set-up costs alone at between £300 million and £400 million (5.31), with office set-up costs on top. Some people would not trust any number emanating from DWP, but that number meets the ball-park test – it is of the same order as the cost of a tax administration.

So there we have it: not Patrick’s £200 million; not the claimed £2.7 billion. But probably closer to £2 billion than £1 billion. If the right answer is £1.5 billion, that means £300 per Scot, or say £800 per average Scottish household. It is not big in relation to a lifetime of independence. But nor is it trivial. It might well be recouped by some of the efficiency gains in taxation and elsewhere that Patrick mentions. But such recoupment would be gradual and would not start until the one-off costs had all been incurred.

—

This is a critique of Patrick Dunleavy’s recent report,’Transitioning to a new Scottish state‘. Patrick responds to Iain in a blog post that can be found here. Both Iain and Patrick will be participating in an event on July 1st at the LSE, ‘Scotland and England: what future for the union?‘.

Note: This article gives the views of the author, and not the position of Democratic Audit, nor of the London School of Economics. This piece also appears on the LSE Politics and Policy blog. Please read our comments policy before posting.

—

Iain McLean is Professor of Politics, Oxford University. He is co-author of Scotland’s Choices (2nd edition 2014) and co-editor of Enlightening the Constitutional Debate. These works explore the themes of this post in more detail.

Iain McLean is Professor of Politics, Oxford University. He is co-author of Scotland’s Choices (2nd edition 2014) and co-editor of Enlightening the Constitutional Debate. These works explore the themes of this post in more detail.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

What will it really cost to set up an independent Scotland? A critique of Patrick Dunleavy’s report https://t.co/RI4o4sj1tP

What will it really cost to set up an independent Scotland? A critique of Patrick Dunleavy’s report https://t.co/n2dcVphrdV