Parliamentary salaries are frequently a source of party funding, but what are the implications for democracy?

In nearly all modern democracies, parliamentarians by now receive a full-time salary in order to attract qualified candidates and representatives from all corners of the society. These payments are, in principle, not intended to constitute an additional source of party income. Yet, Nicole Bolleyer and Siim Trumm have shown that in many democracies they are exactly that. The regular collection of a fixed salary share from parliamentarians is not just a widespread practice, but for many parties also a lucrative one.

How should Parliamentarians be spending their payslip? (Credit: George GrInsted, CC BY SA 2.0)

Money is playing an increasingly important role for parties to successfully compete for votes and seats. It is vital to navigate the electoral uncertainty that characterises contemporary democracies where voting behaviour is increasingly volatile and campaign costs have risen exponentially. With revenues from membership fees in decline and stricter campaign finance regulation being adopted in more and more countries, the question arises which other income sources parties can exploit without violating legal norms, including those resources that are not earmarked for party political usage.

Parliamentary salaries as indirect party funding? A cross-national overview

One widespread, but little explored, informal strategy of parties to access state resources is the ‘taxing’ of elected office-holders’ salaries. That is, parties adopt intra-organisational rules that expect MPs to regularly donate a fixed share of their salaries to party coffers (i.e., a practice clearly distinct from voluntary, ad hoc, donations).

Looking at 124 parliamentary parties across 19 advanced European and Anglo-Saxon democracies, we found that the establishment of an institutionalised taxing regime is indeed widespread. As many as 79 parties (63.7%) expect their MPs to provide regular donations to party coffers and only in two countries – Canada and the US – we did not find the practice at all. These contributions can be significant. While 40 parties take a share below 10% of their MPs’ base salary, 31 parties request a share between 10%-30%, and 8 parties take more than 30%. The average tax corresponds to 13.3% of MPs’ base salary. With the average purchasing power adjusted salary for the elected representatives of those 79 parties being around 5,800€ per month, these 13.3% tax shares constitute monthly payments of over 770€. Consequently, parties are able to informally redirect significant amounts of money away from MPs’ private accounts to party coffers.

Information on how much this income source constitutes of overall party revenue is rare. However, parties in Germany – unusually – have to officially document party taxes as separate income source. Party taxes’ contribution to the overall income of parties (including local, regional and national levels) represented in the Bundestag is indeed significant. In 2008, the proportion of revenue raised from party taxes ranged from 6.6% (the Christian Social Union) to 20.2% (the Greens), with the two biggest parties Christian Democrats (12.2%) and Social Democrats (13.2%) being located in between.

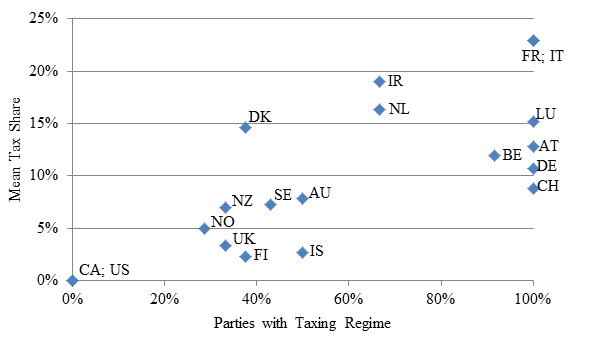

Figure 1 summarises parties’ taxing practices country by country. An interesting narrative appears when looking at the clustering of countries. It is the Anglo-Saxon and Scandinavian democracies where institutionalised taxing regimes are rarer and, if established, ask for smaller salary shares. The practice is more frequent and taxes higher in other Western European countries and in Central-Europe.

Figure 1: Parties with a taxing regime and mean tax share

In the UK, the practice is not very well known yet a range of parties still engage in it. While some parties such as the Conservative Party do not have an institutionalised taxing regime, in 2011 Labour asked 2% from its national MPs, the SNP collected 4%, Plaid Cymru 3%, and the Green Party asked for 10% (in the latter case the rule could only apply to regional and local office-holders). Liberal Democrats established a 10 per cent minimum rate on their councillors’ allowances in 2009 to be collected by their local parties but did not have a national tax.

Redistribution of parliamentary pay – A practice of the left?

Given the legally non-enforceable nature of this intra-organisational practice, one wonders how parties implement it. After all, MPs can leave politics or join another party if they find a party’s expectation to give up parts of their pay unreasonable. In effect, a taxing regime redistributes money from individual MPs to their party as a collective, which is why taxing practices are more acceptable in leftist parties.

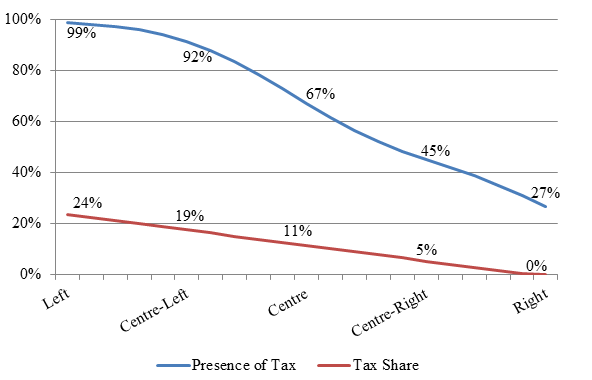

As seen from the figure below, the likelihood of parties to have an institutionalised taxing regime goes down from 99% to 27% when comparing far left to far right parties. Even when looking at centre-left vs. centre-right parties only, the former are considerably more likely to ask their MPs for regular contributions (92% vs.45%). A similar picture emerges when looking at the level of tax. As parties move from left to right, the tax share decreases from 24% to 0%.

Figure 2: Taxing practices and parties’ ideological positions

While party ideology is an important factor (and explains most variation), the systemic environment also plays a role. In democracies where parties are historically closely entangled with the state apparatus, almost all parties tend to tax MP salaries, even though parties on the right collect lower contributions. Similarly, high levels of parliamentary pay are associated with higher tax shares (even though they do not influence whether parties adopt the practice).

What are the implications for democracy?

Informal party practices to access state resources (e.g., the flexible usage of parliamentary allowances and staff) have existed since they started to operate in democratic institutions and such resources were made available. Such practices can be legal, as party taxes are. For citizens, however, legality is not necessarily a sufficient condition for considering whether a practice is acceptable or not. As the disapproval of partisan politics and calls for de-politicisation have intensified in recent years, so have the attempts to regulate the use of resources that parties can access through their public functions in parliament or government.

When it comes to the taxing of politicians’ private income though, this option does not exist. After all politicians have a choice which party to join. From this angle, the payment of party taxes can be seen as an indication of loyalty by MPs to their parties finding reflection in high contributions, or, alternatively, as a rational exchange of resources between MPs and their party. Simultaneously, it can be seen as a contentious practice that raises normative tensions by reinforcing inequalities in inter-party competition between parties represented in parliament and those remaining outside.

To arrive at a nuanced normative evaluation of this practice, we need to not only look at the intensity of the practice and the dependency of any particular party on this income source, but also at the scope of the practice in different democracies – data that is hard to come by. In both Germany and Austria, non-elected members of state boards as well as of top political appointments in the administration pay party taxes, since they are in effect controlled by parties. In Austria, the practice was long applied to meritocratic positions in the civil service and positions in formerly numerous state-owned enterprises.

Finally, the ‘party levies’ on public contracts as collected by French parties in the 1990s resemble the taxing practice discussed here and, at the time, triggered a range of scandals. Once the taxing of office-holders’ salaries goes beyond those positions officially and directly controlled by parties, the line between legality and legitimacy becomes blurred. Then, the collection of party taxes as an indirect but, in principle, legal strategy to top up party income will inevitably become more contentious.

—

Note: this post represents the views of the author, and not those of Democratic Audit or the LSE. Please read our comments policy before posting.

—

Nicole Bolleyer is Associate Professor of Comparative Politics at the University of Exeter

Nicole Bolleyer is Associate Professor of Comparative Politics at the University of Exeter

Siim Trumm is University Teacher in Parliamentary Affairs and Political Analysis at the University of Sheffield

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Parliamentary salaries are frequently a source of party funding, what are the implications? https://t.co/JHYIpWRlbd

Parliamentary salaries often a source of party funds, does this have implications for democracy? Interesting piece…https://t.co/Lbd4DE2dEO

Political parties frequently cream off part of their MPs’ salaries as a source of party funding. Is this democratic? https://t.co/fqphydJfjF

Wow. RT @PJDunleavy: Political parties frequently cream off part of their MPs’ salaries as a source of party funding. https://t.co/EdLwTD4u57

Study of 124 parties in 19 countries shows 64% of parties expect their MPs to ‘donate’ part of their salary to party https://t.co/5phV2eUEYr

Parliamentary salaries as a source of party funding, what are the implications? New post @democraticaudit -> https://t.co/qXt3L44lYt

Parliamentary salaries are frequently a source of party funding, what are the implications? https://t.co/7zmyCLS2jh