Europe’s hidden economy: how governments can bring undeclared work out of the shadows

The so called ‘shadow economy’ refers to work and financial transactions that take place outside of the view of public authorities. Colin C. Williams writes on the scale of this problem in Europe, noting that while the estimated size of the undeclared economy in the EU is around 18.4 per cent of GDP, it is far larger in some eastern European and southern European countries. He argues that a mix of deterrence measures, incentives, and indirect controls offers the best route for governments to bring undeclared work into the declared economy.

Credit: Bill Jacobus, CC BY 2.0

Across the world, many businesses and individuals hide some or all of their monetary transactions from the public authorities either for tax, social security and/or labour law purposes. Clearly, they can gain benefits from doing so, but there are also significant wider costs that result. This undeclared economy creates risksfor the health and safety of workers and damages working conditions, hinders employment creation, puts at greater risk the financial sustainability of social protection systems and undermines the legitimate business environment through unfair competition.

How big is the problem?

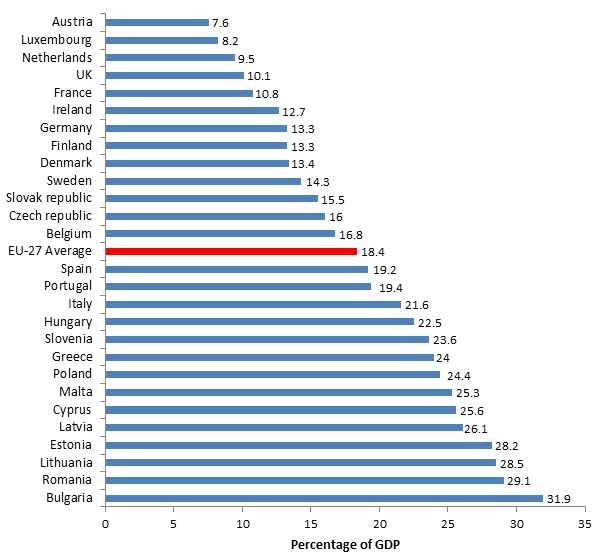

Estimating the amount of undeclared work is akin to trying to count the number of rats in the sewers – by definition, it is hidden from view. Consequently, indirect methods are often employed using proxy indicators such as the amount of cash in circulation. The most widely-used indirect method – the DYMIMIC (dynamic multiple-indicators multiple-causes) technique – estimates the size of the undeclared economy in the European Union (EU) to be 18.4 per cent of GDP, ranging from 7.6 per cent in Austria to 31.9 per cent in Bulgaria, with a clear East-West and North-South divide (see Figure 1). No Western and Northern European countries have undeclared economies larger than the EU average and most East-Central and Southern European nations have above average undeclared economies.

Figure 1: Size of the undeclared economy in Europe by country (2012, percentage of GDP)

Note: Derived from Schneider (2013)

If all this undeclared work was declared, then European public expenditure could increase by around one-fifth, and healthcare expenditure for example could be doubled.

What activities take place in the undeclared economy?

A long-standing view has been that the undeclared economy involves low-paid waged work conducted under ‘sweatshop’ conditions. However, there is a continuum of wage levels in the undeclared economy, just as there is in the declared economy. Although the mean wage is lower than in the declared economy, there is overlap, with some undeclared waged work being higher paid than declared employment. There is also recognition that some declared employees sometimes receive two wages from their employer; an official declared salary and an additional undeclared (‘envelope’) wage.

However, much undeclared work is self-employment. At one end are profit-motivated varieties. These range from ‘bogus self-employment’, where a person works for one employer but is self-employed and pays no wage tax and has no rights (e.g. dismissal protection, vacation entitlements), through to various forms of ‘proper’ self-employment. This ranges from registered traders conducting a portion of their trade off-the-books, to unregistered enterprises trading wholly off-the-books. One outcome has been a re-reading of the undeclared economy as a ‘hidden enterprise culture’. Indeed, in both OECD nations and developing countries, two-thirds of all businesses start-up unregistered in the informal economy.

Yet other undeclared self-employment is more community-oriented and not market-like, ranging from for-profit entrepreneurs conducting jobs for social rationales (e.g. when an elderly person is charged less than the market rate) to paid favours conducted for, and by, close social relations to help each other out (e.g. paying an unemployed family member to do your decorating so as to give them money, which they would not otherwise accept because they would see it as charity).

What can policy-makers do about it?

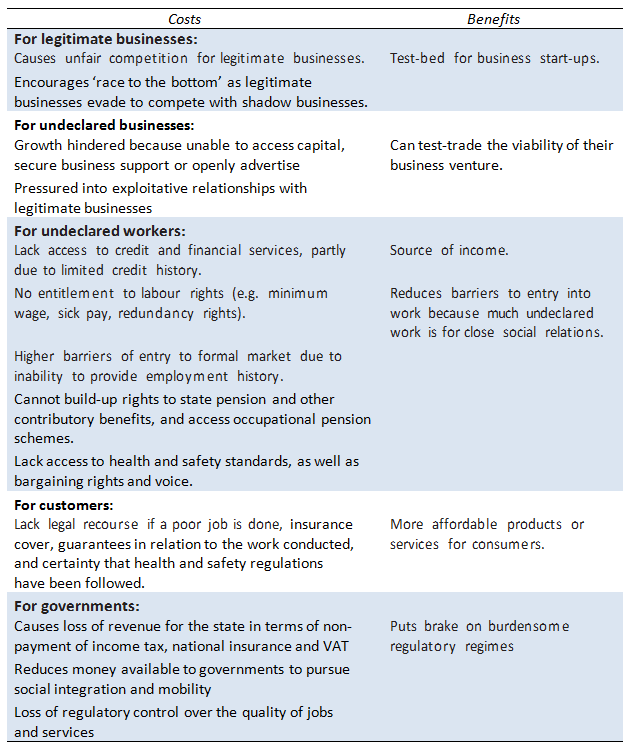

There are four hypothetical policy choices with regard to undeclared work: do nothing; move declared work into the undeclared economy; eradicate the undeclared economy, or transfer undeclared work into the declared economy. Table 1 summarises the various costs of the undeclared economy along with some potential benefits that have been so far less considered.

Table 1: Costs and benefits of the undeclared economy

Note: Derived from Williams (2014)

The table shows that doing nothing is unacceptable; it leaves intact the various costs on formal businesses, undeclared enterprises and workers, customers and governments. The second option of de-regulating the declared economy is also a non-starter because it results in a levelling down of working conditions. The third approach, eradicating undeclared work, is unworkable because it would with one hand squash precisely the active citizenship and entrepreneurship that with the other hand governments want to foster. Moving undeclared work into the declared economy thus appears the most viable policy option. How, therefore, can this best be done?

Direct vs indirect controls

It is not easy to change the behaviour of businesses, workers and consumers. Conventionally, governments have viewed participants as rational economic actors and sought to ensure that the costs of operating in the undeclared economy are outweighed by the benefits of operating in the declared economy. As Table 2 shows, this is accomplished in the direct controls approach usually by using ‘sticks’ to punish non-compliant (‘bad’) behaviour (i.e. negative reinforcement), although recent years have seen the increasing use of ‘carrots’ to reward compliant (‘good’) behaviour (i.e. positive reinforcement).

Relatively less discussed in European policy circles until now has been the indirect controls approach which views participants more as ‘social actors’ and instead focuses upon developing the social contract between the state and citizens to engender a voluntary commitment to compliant behaviour and thus greater self-regulation.

Table 2: Policy measures for tackling Europe’s undeclared economy

Note: Derived from Williams (2014)

Interviewing senior government officials involved in tackling the undeclared economy in 31 European countries in 2010, 57 per cent stated that the use of ‘sticks’ (i.e. deterrence measures) is accorded the most importance in their country, 33 per cent ‘carrots’ (i.e. incentive measures) and 10 per cent indirect controls.

However, these different policy measures to harness this sphere are not mutually exclusive. Indeed, there are at least two ways of combining them. Firstly, a responsive regulation approach starts out by openly engaging citizens to consider their obligations and take responsibility for regulating themselves rather than need to be regulated by external rules. This facilitating of voluntary self-regulated compliance is thenfollowed by persuasion through incentives and only as a last resort for the small minority refusing to be compliant does it use punitive measures.

A second approach is the ‘slippery slope framework’ which pursues both voluntary and enforced compliance concurrently by developing both greater trust in authorities and the greater power of authorities. Until now, however, there has been little evaluation of which sequencing and/or combination is the most effective means of harnessing this sphere.

What is certain nevertheless, is that the currently dominant approach in Europe of using ‘sticks’ to elicit compliant behaviour needs to change. The EU platform for tackling undeclared work currently being established by the European Parliament could well facilitate this shift. Hopefully, it will do so.

—

Note: This article gives the views of the author, and not the position of Democratic Audit UK, nor of the London School of Economics. It originally appeared on LSE EUROPP – European Politics and Policy. Please read our comments policy before commenting.

—

Colin C Williams is Professor of Public Policy in the Sheffield University Management School at the University of Sheffield.

Colin C Williams is Professor of Public Policy in the Sheffield University Management School at the University of Sheffield.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Europe’s hidden economy how gov’s can bring undeclared work out the shadows #StrategicHustle #GetHired #TheEBook https://t.co/fcbNZ4FT8U

Interesting article. “Europe’s hidden #economy: how governments can bring undeclared #work out of the shadows” https://t.co/3vNu8mGO9Q

Europe’s hidden economy: how governments can bring undeclared work out of the shadows – https://t.co/vkX0T9bkel #GoogleAlerts

Europe’s hidden economy: how governments can bring undeclared work out of the shadows https://t.co/twYxr4jICQ

Europe’s hidden economy: how governments can bring undeclared work out of the shadows https://t.co/xqdnY2v19W #Option2Spoil

Europe’s hidden economy: how governments can bring undeclared work out of the shadows https://t.co/HioxpAk1mW https://t.co/3GP1kBjWu9