Taxing the rich leads to representative government. Happy 800th birthday, Magna Carta!

If King John and his successors hadn’t taxed the rich and powerful so heavily, argues Deborah Boucoyannis, we might not have representative government and strong courts today. She writes that once rights are codified, as they were in Magna Carta, a parliament — what we like to call “limited government”— produces more state revenue. Or to flip the American revolutionary slogan again, representative government increases taxation.

Credit: Trevor, CC BY NC 2.0

Few historical incidents have left as profound an impact on the Anglo-American historical imagination as Magna Carta. It gave birth to a powerful narrative, that of freemen banding together to demand a list of rights from a cruel and oppressive king. The king had to pledge to stop fleecing them without constraint, throwing them into dungeons without trial, and taking their lands without reason.

In this story, a new era of limited, law-abiding government was ushered in, the basis of the liberal, constitutional order that blossomed four centuries later in England and in the eighteenth century in the United States. A cherished idea took solid historical roots: that constitutional governance means effective limits to high taxation (always assumed to be arbitrary), imposed by assertive social groups.

Few historical incidents, however, have had a more unfortunate and misguided influence on how we understand the politics of rights, taxation, and representation. The deepest lesson to be found here is that the first glimmers of representative government came out of the king’s power to tax the most powerful. Without taxation — and a significant set of taxes, as my recent research is showing — why would the wealthy barons have demanded seats at the table? And who, beside the mighty barons, had the power to stand up to the king and insist the seats remain available to them?

The powerful barons were heavily taxed—which pushed them to demand their rights

That Magna Carta was granted to barons, the most powerful political class in the realm, is routinely mentioned but rarely fully appreciated. This formidable group included warriors and major landlords holding critical offices of the state. They had to pay because they all held land from the king; as I explain in my forthcoming article, these were burdens of the privileged classes.

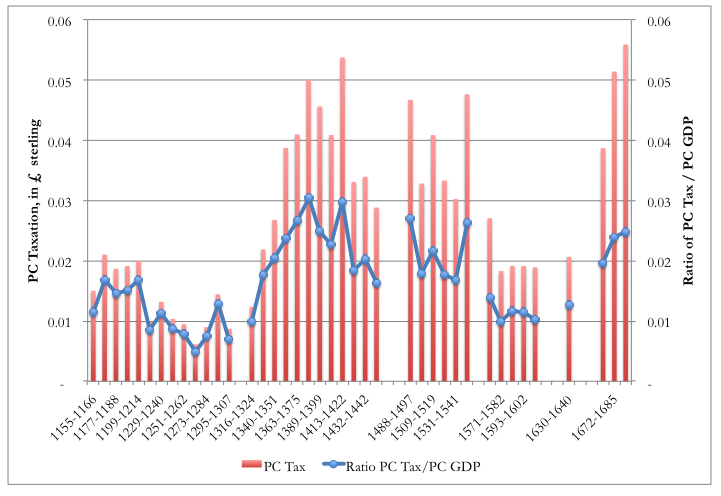

The burdens were in fact unprecedented, as the chart below shows. It’s thus not hard to see why the barons were up in arms — the real question is why they had to wait so long, until John was defeated in war, to register their protest and demand limits.

Figure 1: Feudal crown exactions from English nobles, 1154 to 1216, in pounds, adjusted for Inflation

This astonishing level of taxation was what pushed these most powerful actors in the country later on to insist on being present in Parliament, which is then why Parliament took root in a much more solid way than anywhere else in Europe (as I have also explained elsewhere on this page).

Magna Carta acquired the significance it did because powerful social actors had tremendous interest in demanding its ongoing enforcement. That did not happen across Europe. In countries like France and Spain, the nobility became exempt from taxes. Because they had no reason to keep seats in assemblies, those deliberative bodies either lapsed or were marginalised.

In other words, the American revolutionary slogan is missing the most critical point: no taxation of the rich, no representation.

Magna Carta did not blunt taxation

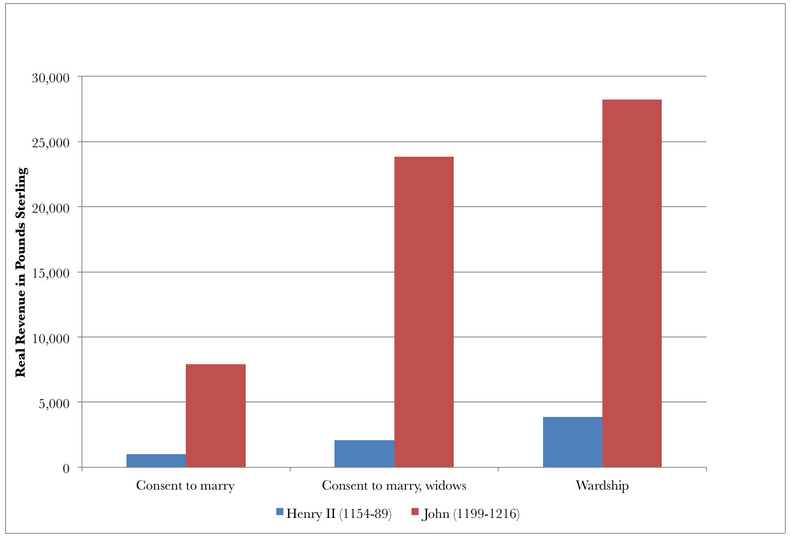

A second critical point about Magna Carta is typically ignored: After John, the crown kept taxing at remarkable levels. The advent of Parliament certainly did not slow down the crown’s extractive prowess — to the contrary (a short-lived revenue decline resulted from the minority of Henry III and the few wars throughout the thirteenth century).

English royal revenue from the late 1200s onwards simply kept rising. That’s what I show with new data that for the first time take into account reliable estimates of national wealth. English kings demanded ever higher per capita revenue, adjusted both for inflation and for the expansion of the economy we know to have happened in the thirteenth century.

Figure 2: English real revenue per capita and real per capita revenue as a ratio to GDP

Data: Ramsay 1926, adjusted, O’Brien, European State Finance Database ©, Broadberry, Campbell, Klein, Overton, van Leuwen, 2010; figure, Deborah Boucoyannis)

High taxes were no accident in a state with rights defined and with a parliament. Historians have long noted that imposing “constitutional limits” typically lead the state to extract more. The political scientist/economic historian Mark Dincecco has even shown that for the period after 1660, having a constitutional, “limited” regime generated up to 65 per cent more revenue than came from countries without representative institutions. England and the Netherlands were far more adept at extracting revenue from their subjects than those reputed predatory, absolutist kings of France or Spain.

Although the modern record is a lot harder to decipher, the pre-modern one seems pretty clear. Once rights are codified, a parliament — what we like to call “limited government”— produces more state revenue. Or to flip the revolutionary slogan again, representative government increases taxation.

This means that some of our most intuitive notions and distinctions about rights, taxation, and political participation need a critical correction. Two of the most noted social scientists writing today, Daron Acemoglu and James Robinson, for instance, have proposed a powerful distinction between inclusive and extractive states, in order to explain why nations fail.

Such a distinction assumes that the more inclusive a state is, the less extractive it will be and vice versa. But this is not really what is going on. Having a state that is more inclusive means it is only less arbitrary; in practice, it means taking more, precisely because it secured consent.

Magna Carta survived because the English state was powerful

A final important point is typically missed in all the talk about Magna Carta. King John was indeed momentarily weak and had to capitulate. Most accounts use this weakness to illustrate how representation and rights are wrested from the state by rising groups. But such a moment of monarchical weakness was far from unique. As the political scientist David Stasavage argues, similar “moments” can be found throughout Europe, from Castile to Hungary.

What made the difference in England was that this moment was sandwiched between long periods of royal strength, with precocious institution building, especially of courts. Henry II (1154-89) is widely credited with setting the foundations of the Common Law. Henry III (1216-1272) consolidated different aspects of the courts, making them regular and systematic throughout the kingdom.

In a country and time when tax assessments depended on the sworn testimony of neighbors, who were called to answer how many oxen the house next door could boast, a well-functioning court system and the penal rules this implied was simply indispensable for effective monitoring and enforcement.

The only reason Magna Carta became what it is, a symbol of a living tradition rather than just a historical record (like the Hungarian Golden Bull in 1222 with which it is sometimes compared) is because the English state remained strong and controlled effective institutions throughout its territory — just as it could tax its most powerful subjects. Without this strength, none of the principles adumbrated in Magna Carta could have become law, even if that took in some cases centuries.

Those who are taking from Magna Carta the lesson that the state needs to be weak and limited are simply taking too narrow a historical slice and exactly the wrong historical lesson.

—

Note: This article was originally published on the Monkey Cage blog and the LSE Politics and Policy blog, and is re-published with permission. It gives the views of the authors, and not the position of Democratic Audit UK, nor of the London School of Economics. Please read our comments policy before posting.

—

Deborah Boucoyannis is an Assistant Professor of politics the University of Virginia and a member of the Scholars Strategy Network.

Deborah Boucoyannis is an Assistant Professor of politics the University of Virginia and a member of the Scholars Strategy Network.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Taxing the rich leads to representative government. Happy 800th birthday, Magna Carta! https://t.co/ls581SQNMa

Taxing the rich leads to representative government. Happy 800th birthday, Magna Carta!: If King John and his s… https://t.co/fqiet1NaNi

Taxing the rich leads to representative government. Happy 800th birthday, Magna Carta! https://t.co/X8bCn3Cgmz #Option2Spoil

Taxing the rich leads to representative government. Happy 800th birthday, Magna Carta! https://t.co/uM2I4I6w0b https://t.co/D7AsOu5siJ